How to Offset the Cost of Minimum Wage Increases in the UK

The national living wage and minimum wages for those younger than 25 gone up from the 1st of April, which is great news for employees.

For employers, labour costs are one of the largest variable costs that businesses are having to deal with.

Although the wage increases may look small, they quickly add up. As an example, if you are paying the UK Living Wage to 30 staff all over 25 who each work three 8 hour shifts per week, your weekly wage bill will increase by £275 and your yearly bill by £14,000.

We know many of our clients pay their staff more than the national minimum wage, but with the average wage growth (pre COVID in 2018) at 3.4% (ONS link here) all businesses like yours will feel the pressure of increasing wage costs.

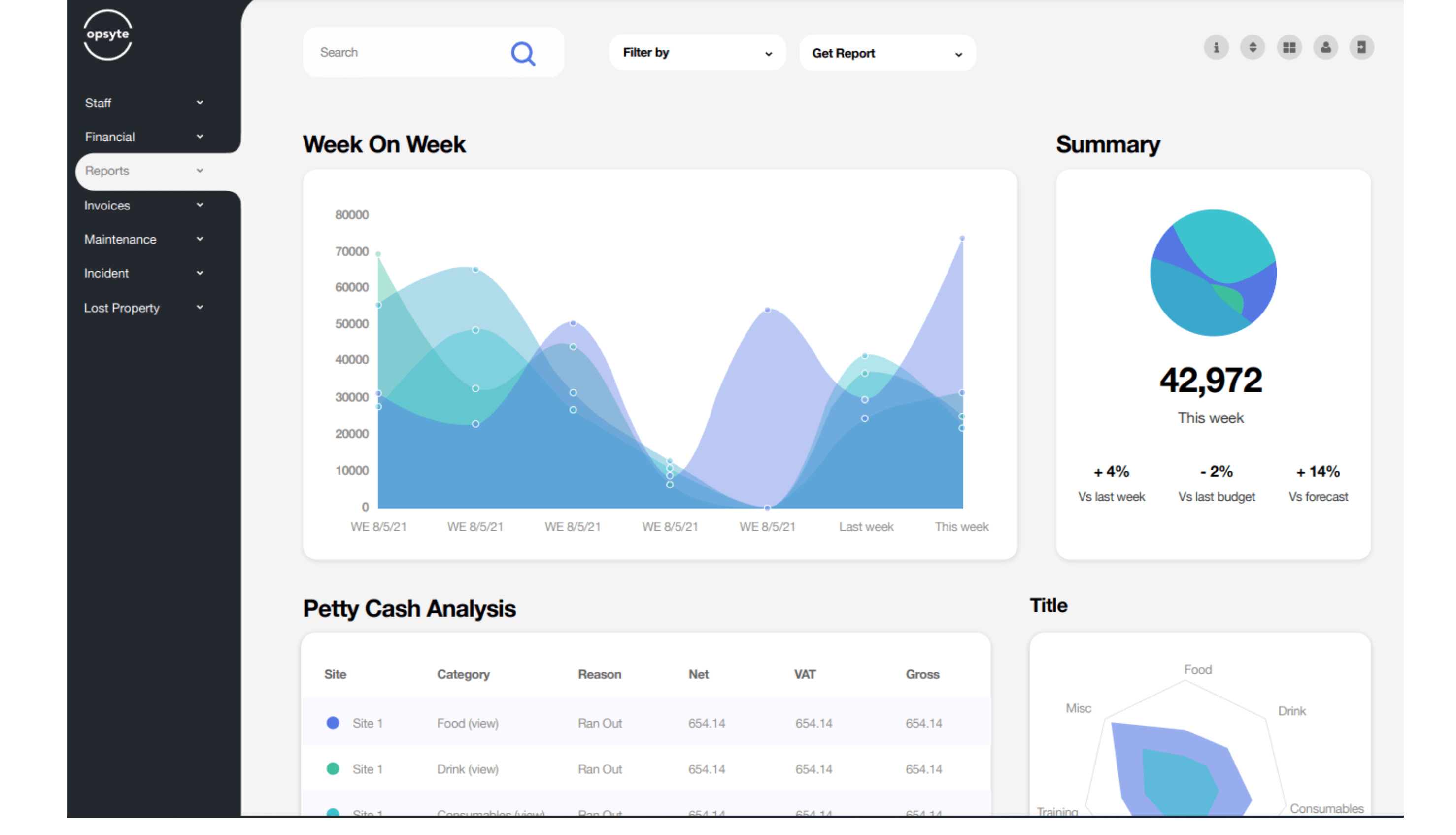

There is a way to offset your increased wage costs

By using Opsyte to manage your T&A (time and attendance, i.e. staff clocking in and out software) our clients tell us the average wage saving is somewhere between 4% and 10%.

With our fixed monthly pricing this means you can be confident you will be saving money by optimising your labour costs whilst paying for a great service.

Using Opsyte you and your staff can manage clock in and out data using smartphones as well as a fixed tablet.

Once clock in and out data is approved by management, the hours worked can be sent directly to your payroll processor.